28+ rules to refinance mortgage

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Low Fixed Mortgage Refinance Rates Updated Daily.

Steps To Refinancing Your Mortgage Global Integrity Finance

Ad Refinance Your Mortgage Into A Low Interest Rate.

. You need a decent. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Homeowners spend an average of 284 of their pre-tax income on mortgage payments.

You will not have to sell the home. No SNN Needed to Check Rates. Dont Wait For A Stimulus From Congress Refinance Instead.

If you elect to roll these costs into your new refinanced loan this can increase your new monthly payments. Web In fact many mortgage-based commercials recommend refinancing to save money by taking advantage of historically low rates. Your lender will also look at your.

If youre at least 62 years old a reverse mortgage can let you turn part of the equity in your home into cash. Get your paperwork in order. Gather recent pay stubs federal tax returns bankbrokerage statements and anything else your mortgage lender requests.

Ad Looking For a Mortgage Refinance. Put Your Equity To Work. Get a Personalized Offer From Best Lenders.

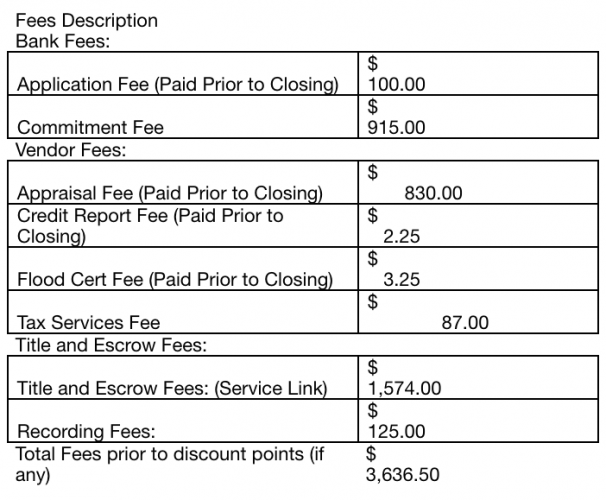

Web Typical mortgage refinance closing costs can range from 2 to 6 of the loans principal. Web Reverse Mortgages. Web If you withdraw the equity and own less than 20 of your home you may pay private mortgage insurance PMI again.

Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Web It is not unusual to pay 3 percent to 6 percent of your outstanding principal in refinancing fees. Lowering your interest rate can lower your monthly payment.

But thats not the only factor you should consider. Web The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can affordThe rule says that you should. Its a good idea to gather the following documentation before meeting with a lender.

Web Typically mortgage refinancing options are reserved for qualified borrowers. Ad There Are Many Reasons To Refinance. Ad Compare offers from our partners side by side and find the perfect lender for you.

You as the homeowner need to have a steady income good credit standing. Lower Your Interest Rate Interest rates are always changing. 1 Leaving equity in your home protects your.

Two most recent pay stubs Two most recent W-2 forms. Web After five years of on-time payments you owe 320000 on your mortgage. Dont Wait For A Stimulus From Congress Refinance Instead.

Typically your homes market value must exceed your mortgage balance by anywhere from 3 to 20. If you refinance that 320000 into a 15-year FRM with an interest rate of 3 youll pay. Save Real Money Today.

Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You. The Best Lenders All In 1 Place. Refinancing fees vary from state to.

See When is it Worth Refinancing Mortgage Lower You Monthly Payments. And homeowners in 21 states and Washington. On a 250000 loan for example refinance closing costs might be 5000-15000.

Lets say that refinancing. These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have. Web To determine the break-even point on your refinance divide the closing costs by the amount youll save each month with your new payment.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web 10 hours agoOn a national level US. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Check Out Our Rates Comparison Chart Before You Decide. Web Step 5. The rule of thumb is that its best to refinance when interest rates are at least 1 lower than your current rate.

Web Conventional cash-out refinance requirements Minimum 620 credit score Maximum 80 LTV ratio Maximum 45-50 DTI ratio Home appraisal required to verify. Ad Top Home Loans. Web When you refinance your mortgage youll usually need to have a significant amount of paperwork to provide proof of your income assets employment credit and property.

Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You. Put Your Equity To Work. How to refinance a mortgage.

Web Your home equity must be sufficient. If rates are better now than when you got your loan refinancing might make sense for you. Web You can also refinance to a longer term to lower your monthly payment.

Compare Refinancing Your House For 2023.

What Is A No Cost Refinance Mortgage And How Does It Work

How To Refinance Your Mortgage Nerdwallet

How To Refinance A Mortgage What You Need To Know Gobankingrates

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

Mortgage Refinance Guide When How To Refinance Mint

When To Refinance Your Mortgage Helpful Guide Youtube

Refinance Rules Expanding To 125 Loan To Value

Refinance Rules Expanding To 125 Loan To Value

Abbotsford Apr30 Real Estate By Black Press Digital Issuu

Emergency Tools To Help Homeowners With Growing Mortgage Payments Include 40 Year Amortizations R Canadahousing

How To Refinance Your Mortgage Loan When Rates Are Low Mint

When To Refinance Your Mortgage Helpful Guide Youtube

:max_bytes(150000):strip_icc()/michele_headshot_002__michele_lerner-5bfc26264cedfd0026c00e70.jpg)

9 Things To Know Before You Refinance Your Mortgage

Mortgage Refinance Guide When How To Refinance Mint

How To Refinance Your Mortgage Bankrate

6 Things To Know About Refinancing Your Mortgage