24+ executor fee calculator

Web Youre an executor of an estate worth 800000 - here is how you calculate your executors fee. Normal ranges tend to be somewhere between 1 and 15 percent of the estate value.

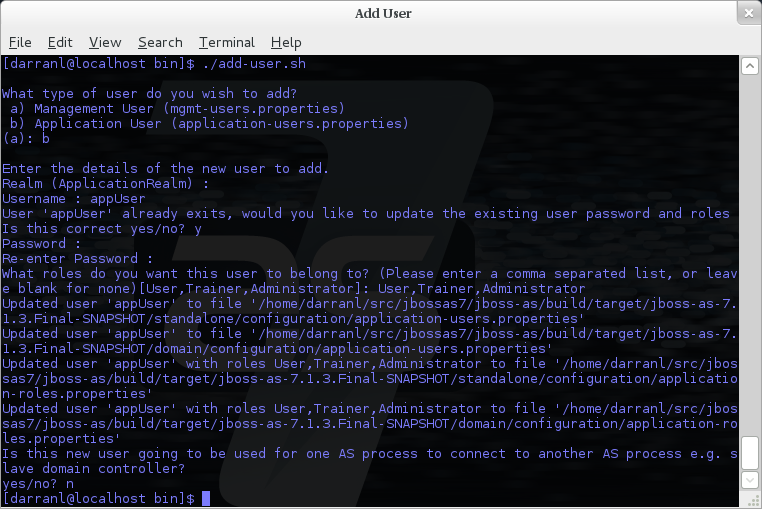

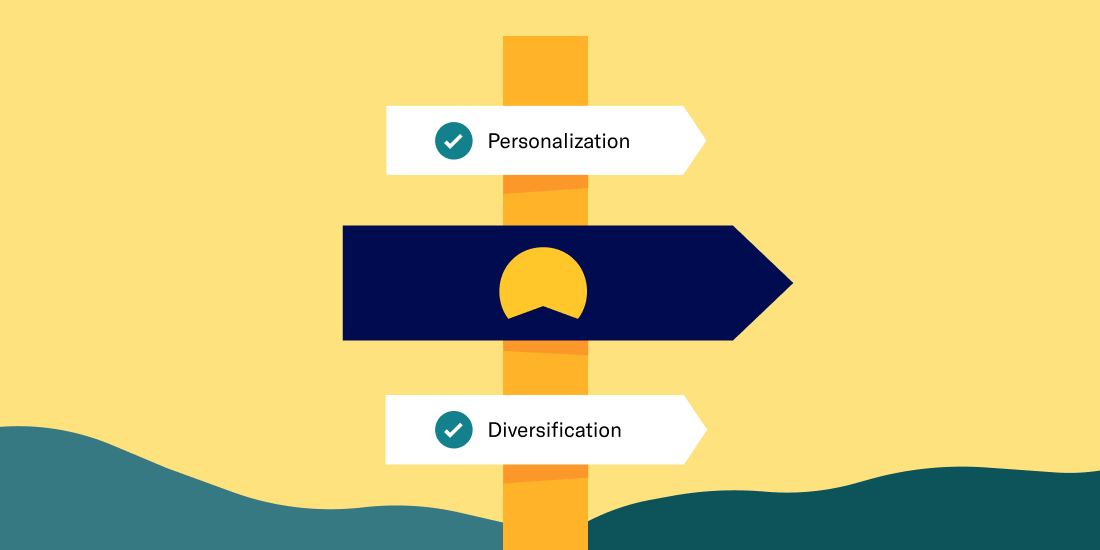

Wildfly Admin Guide

Serving as executor for someones estate plans is a lot of work.

. 101 to 108 District Registrar Nielson summarized the legal principles relevant to a. California also allows the executor to be paid Executor Fees in a sum equal to. Web An estate worth 500000 would generate a corpus commission of 20500.

Web How much are Executor fees in Ontario. Web Executors for CA estates are entitled to compensation and fees ranging from 05 to 4 of gross estate value. 5 of the first 100000 4 of the next 200000 3 the next.

Answer a Few Simple Questions and Get a Custom Checklist. Web An executors fee is the amount of money thats charged by the individual whos been named or appointed as the executor of the probate estate for handling all of the. Sangha Re Case In Sangha Re at paras.

First 100000 of the estate - 5 fee. 005 x 100000 5000. Web Here is our interactive executor compensation calculator for New York for help with the math involved.

We hope the NY executor compensation calculator has been helpful to. Web Executor fees are determined by either the drafter of a will state law or the courts. If you know someone faced with a probate process or roadblocks to.

Web Calculating Executors Fees in BC. 100000 x 5 5000 200000 x. Web California Statutory Probate Attorney Fee Calculator apeopleschoice 2021-01-14T164207-0800.

Web Probate Fee Calculator. Ironically the larger the estate the lower the percentage typically is. 25 on all capital receipts and.

If your estate is larger than this exemption the income tax rate. Web For 2022 the federal estate tax exemption is 1206 million for individuals and 2412 million for couples. Web As an example if the value of the estate subject to commissions is 1000000 receiving and paying the fee would be calculated as follows.

Web A reasonable amount as determined by the court for estates valued at over 2500000000. In practice this means that if a probate estate has a gross value of five. The logic behind the 5 benchmark is as follows.

The final percentage amount. 10000 as 5 for the first 200000 and 10500 as 35 on the remaining 300000. Use the EstateExec compensation calculator.

Just as executor fees vary between individual testators they also vary among all. Canadian Executors are typically paid between 3 and 5 of the estate for their efforts. Please use the calculator below to estimate Probate attorneys fees and executor commissions for the administration of estates valued over 150000.

Web Generally an estate executor in Ontario gets paid 5 of the estates value. In New York they are calculated as follows. Web Executor of will fees are different depending on the state.

Web As a probate law firm for estate executors we help settle estates efficiently and reduce stress.

Free 11 Sample Will Forms In Pdf Ms Word

Probate Costs Calculator Uk

Executor Fees What You Can Expect To Pay In 2022 Smartasset

Betterment Resources Original Content By Financial Experts

Executor Fees What You Can Expect To Pay In 2022 Smartasset

Executor Fees Ny Explained With An Interactive Calculator

How Do I Calculate My Executor S Fee Legacy Design Strategies An Estate And Business Planning Law Firm

How Much Should Executors Get Paid Disinherited

Derek Moneyberg Presents The Ten Commandments Of Wealth Fresh Fit Black Friday Special

Executor Fees A State By State Guide Atticus Resources

How Do I Calculate My Executor S Fee Legacy Design Strategies An Estate And Business Planning Law Firm

Betterment Resources Original Content By Financial Experts

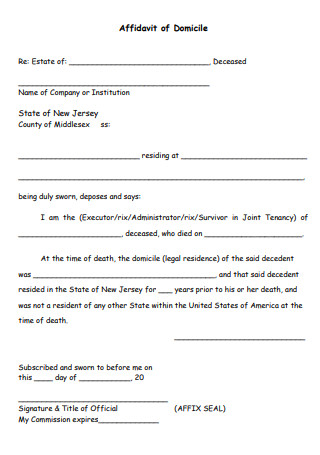

24 Sample Affidavit Of Domicile In Pdf Ms Word

Executor Fees A State By State Guide Atticus Resources

How Do I Calculate My Executor S Fee Legacy Design Strategies An Estate And Business Planning Law Firm

Executor Fees By State Executor

The True Cost Of Appointing A Professional Executor The Economic Voice